7 Simple Techniques For Federated Funding Partners Reviews

Table of ContentsThe Facts About Federated Funding Partners UncoveredFederated Funding Partners for BeginnersFederated Funding Partners Bbb for DummiesWhat Does Federated Funding Partners Legit Do?The Basic Principles Of Federated Funding Partners Reviews Some Known Factual Statements About Federated Funding Partners

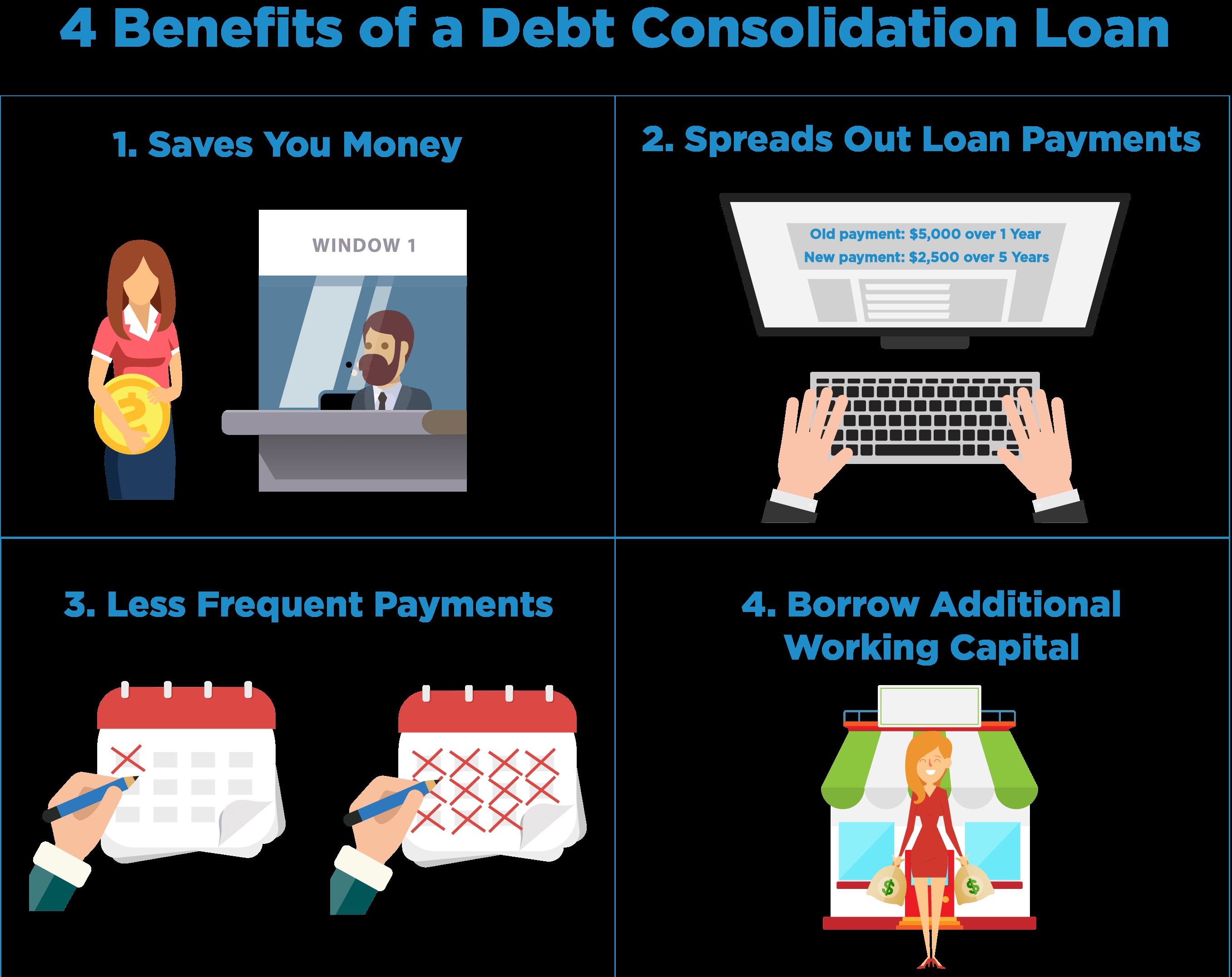

Right here's what you require to understand about financial obligation loan consolidation: What are the advantages of debt consolidation? Reducing passion payments. federated funding partners legit. The key benefit of financial obligation consolidation is saving on interest costs. Long-term debt with a high passion price can set you back thousands of dollars in passion settlements over the life of the lending.Streamlined repayments. With just one regular monthly payment to make, handling your financial obligation will certainly be a great deal easier. Fixed payment timeline. Financial obligation debt consolidation usually suggests having a set payment timeline. This makes budgeting simple and permits you to make long-lasting financial objectives, with a set date for when you will certainly be debt-free.

If you have actually been falling back on your regular monthly settlements, moving your several debts to a solitary low-interest financing can assist to enhance your score. What are the downsides of debt consolidation? May prolong the settlement timeline of the debt. Moving financial obligation to a new financing can sometimes include expanding the term of the car loan.

The Federated Funding Partners Diaries

Doesn't get rid of untrustworthy investing habits. If spending beyond your means and also careless finance is what landed the consumer in debt to begin with, settling financial debt by itself will certainly not solve the trouble. Lower interest rate might not last. Many reduced- or no-interest charge card only supply these features as a temporary promotion.

Just how can I settle my debt? You have numerous options for financial obligation loan consolidation, each with its very own advantages and disadvantages. Individual Lending or Line Of Credit (PLOC): Getting an unprotected car loan from Abilene Educators FCU will certainly allow you to repay all your impressive lendings quickly and move your debts into one low-interest lending (federated funding partners reviews).

Likewise, since they're unsecured, the rates of interest on these finances can be high. Fortunate for you, however, as a member of Abilene Teachers FCU you have accessibility to individual lendings or personal lines of credit history without any origination fees and rates of interest as low as 7. 75% APR *. Inspect out all our alternatives! House Equity Funding (HEL): A residence equity financing uses your residence as security for a fixed-term loan.

Federated Funding Partners Reviews Can Be Fun For Anyone

Additionally, if the value of your residence decreases, you may end up owing a lot more on your home than what it deserves. Lastly, payment terms for HELs can be upward of 10 years. As protected financial obligation, interest on HELs will be budget friendly as well as may provide you with considerable cost savings. Interest on home equity car loan items is usually tax-deductible as well.

You could just desire to combine your various credit lines. As opposed to attempting to grasp all those numbers in your head or creating a legendary spreadsheet, you may simply wish to consolidate your different lines of credit score. Financial obligation loan consolidation is when you integrate existing financial debts into a brand-new, solitary loan.

What Is Debt Combination? It's when you take out one finance or line of credit score as well as utilize it to pay off your numerous debtswhether that's pupil financings, cars and truck finances, or credit score card financial debt.

The Only Guide to Federated Funding Partners Legit

Credit report relief programs can aid you consolidate your financial debt, yet they aren't getting you a brand-new loanit's only debt consolidation. Applying For a Financial Debt Consolidation Finance When choosing a financial obligation loan consolidation lending, look for one that has a rate of interest price and terms that fit into your overall monetary image.

The Only Guide for Federated Funding Partners Reviews

With safeguarded loans, you utilize a property like a residence or automobile to guarantee the funding. If something happens as well as you can not pay back the loan, then the financial institution can seize the property that is functioning as security. An unsecured financial debt combination lending can aid you prevent placing various other properties on the line.

This is since individuals can save a substantial quantity by settling their high interest charge card financial debt with a new lower-interest funding. The first step is usually getting a charge card debt consolidation lending. There are numerous financial institutions, debt see this page unions, and online loan providers that provide car loans for combining financial obligation. In many cases, the application procedure can be finished online.

Usually, individuals looking for debt consolidation financings have several sources of debt and desire to accomplish two things: First, lower their interest rateand thereby pay much less each monthand minimize the amount they have to pay over the life of their funding. Second, they are trying to combine several finances into one, making it less complicated to track month-to-month repayments.

The smart Trick of Federated Funding Partners Legit That Nobody is Discussing

36 in passion. Yet if you consolidate that financial obligation with a new loan that has an 8% passion price as well as a 10-year term, you will pay $4,559. 31 in interest. Not only would you conserve money in passion by settling your credit scores card financial debt, however you can potentially improve your credit rating by repaying your combined finance in a timely manner.